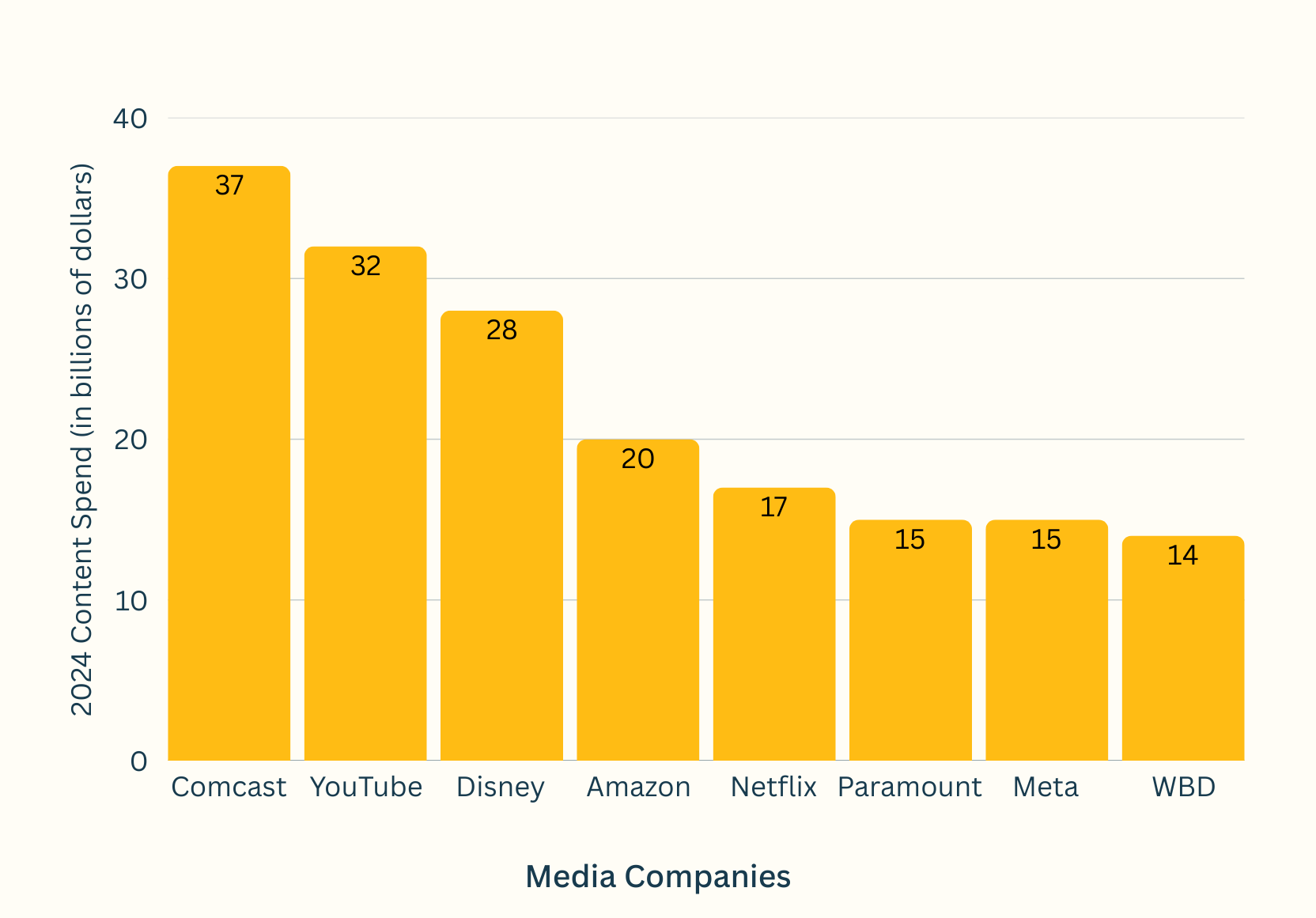

For years, industry watchers have asked if we've hit "peak content"—the point where there's simply too much TV and film for anyone to watch. But media companies just spent a record $210B on content in 2024, up 4% from 2023, according to new KPMG analysis. The big spenders:

- Comcast/NBCUniversal: $37B (flat from 2023)—still top dog

- YouTube: $32B—huge for a platform built on user videos

- Disney: $28B—juggling streaming, studios, and traditional TV

- Amazon: $20B—betting big on Thursday Night Football and Prime originals

- Netflix: $17B—spending less than rivals but squeezing more value per dollar

The creator economy is growing: Traditional studios and the creator economy are now competing in the same arena. YouTube's $32B represents ad revenue shared with millions of creators, not money spent on producing shows. Same "content spending" label, totally different game. (YouTube also spends on music licensing and NFL Sunday Ticket, but creator payouts dominate.)

What's really happening: Since 2020, these companies have increased spending by 10% yearly on average. But the money's moving: sports rights are soaring, scripted shows are shrinking, and creator content plus ad-supported streaming are the new growth engines. We're not hitting peak content, we're just spreading the money differently.

Want more of The Dailies? Every Monday, Wednesday and Friday, we'll deliver the most important industry scoops directly to your inbox. Sign up here!